Learn the precise prices to insure the different vehicles you're thinking about before making a purchase. 7. Rise Your Deductibles When selecting automobile insurance policy, you can commonly pick a insurance deductible, which is the quantity of cash you would have to pay before insurance coverage foots the bill in the occasion of a crash, theft, or various other sorts of damage to the vehicle.

8. Boost Your Credit Score A motorist's document is clearly a huge consider determining automobile insurance coverage prices. It makes sense that a vehicle driver that has been in a lot of accidents might cost the insurance coverage business a great deal of money. People are often shocked to discover that insurance companies may also consider credit history rankings when establishing insurance policy costs.

Regardless of whether that's true, be aware that your credit scores ranking can be a variable in figuring insurance coverage premiums, and do your utmost to keep it high.

Consider Area When Estimating Car Insurance Policy Rates It's unlikely that you will certainly relocate to a different state merely due to the fact that it has reduced vehicle insurance rates. When planning an action, the possible adjustment in your cars and truck insurance price is something you will want to factor into your budget.

Farmers Insurance: Insurance Quotes For Home, Auto, & Life - The Facts

If the worth of the automobile is only $1,000 and the crash coverage costs $500 per year, it may not make feeling to purchase it. GEICO, for example, provides a "prospective financial savings" of 25% if you have an anti-theft system in your automobile.

cars low cost cheap insurance laws

cars low cost cheap insurance laws

Auto alarm systems and Lo, Jacks are 2 sorts of tools you may wish to make inquiries around. If your key inspiration for installing an anti-theft device is to reduce your insurance policy costs, think about whether the cost of adding the tool will certainly cause a substantial adequate savings to be worth the trouble as well as expenditure.

Talk with Your Agent It's crucial to note that there might be other price financial savings to be had in enhancement to the ones described in this post. That's why it frequently makes feeling to ask if there are any type of special discounts the company supplies, such as for armed forces workers or employees of a particular company.

However, there are many points you can do to minimize the sting (cheap insurance). These 15 pointers should get you driving in the ideal direction. Keep in mind likewise to compare the finest auto insurance companies to locate the one that fits your protection requirements and also budget plan.

8 Easy Facts About How Much Does Full Coverage Car Insurance Cost? - Cheap ... Shown

insurance affordable vehicle insurance cars car

insurance affordable vehicle insurance cars car

There are plenty of things to see and perform in The golden state, as well as you're mosting likely to require an auto if you wish to experience whatever. And also having a car implies having inexpensive vehicle insurance coverage. While vehicle insurance policy is easy sufficient to discover, cost effective isn't so simple to discover. Which's why most of The golden state vehicle drivers are persuaded they are paying way too much for insurance.

We are mosting likely to walk you through whatever you require to understand to get reliable coverage at the most effective possible rate! Exactly How Does Vehicle Insurance Policy Job? Among the reasons that low-priced auto insurance coverage in California is hard to locate is that lots of motorists don't recognize that much concerning vehicle insurance policy - car insurance.

On the many fundamental level, auto insurance assists protect you and various other motorists when traveling. Insurance coverage aids to pay for the damages that we create to others or that others create to us as a result of an auto accident or various other certifying occasion. affordable auto insurance. Various sort of insurance safeguard you as well as your vehicle in various sort of ways.

Crash insurance pays for damages to your auto regardless of that was at mistake. Extensive insurance coverage helps cover points that might happen to your car when you're not driving (such as burglary and criminal damage). The more degrees of auto insurance coverage you have, the a lot more defense you and your car have against injuries and also damage. vehicle.

Top Guidelines Of Eligibility And Cost - New York State Department Of Health

cheaper auto insurance low-cost auto insurance cheapest auto insurance insurance companies

cheaper auto insurance low-cost auto insurance cheapest auto insurance insurance companies

If you wish to get affordable cars and truck insurance policy, you need to discover the equilibrium between how much coverage you need and how much money you are willing to pay every month. That's where Cost-U-Less Insurance coverage can assist. Is Car Insurance Affordable for Californians? As we said previously, many The golden state vehicle drivers are encouraged they Discover more here are paying way too much for auto insurance coverage.

The average expense of complete protection cars and truck insurance in The golden state is $172/month. The nationwide ordinary cost of complete insurance coverage car insurance is $139/month, while the typical minimal car insurance coverage is $47/month.

Automobile insurance premiums depend on numerous aspects, some within your control and some outside of your control. Agents at Cost-U-Less Insurance coverage are well-versed in finding ways to help you make the most of your insurance dollars - car insured.

San Franciso chauffeurs pay an average of $233. Chauffeurs in Los Angeles are really clearing those purses: their average price of auto insurance policy is a monstrous $274! The location you live in is one of the major variables that car insurance service providers make use of to figure out how much you pay on your regular monthly costs.

A Biased View of Mercury Insurance: Auto, Home, Business Insurance & More

Compare Cars And Truck Insurance Coverage Fees Currently you understand that various variables aid determine exactly how much you spend for auto insurance policy. Among the most reliable methods to reduce your automobile insurance costs is to compare various insurance coverage carriers, which is something we focus on at Cost-U-Less Insurance policy. cars. If you spend for your insurance coverage one month at a time, you can commonly switch insurance policy providers whenever you wish to.

cheaper auto prices insurance companies

cheaper auto prices insurance companies

Average Auto Insurance Policy Rates by Protection Level When it comes to protecting your cars and truck, we understand that every person's needs are various. That's why we provide different sorts of car insurance policy coverage. Having full coverage helps you stay safe when traveling. This is likewise among the reasons that the ordinary price of car insurance policy varies in between customers.

A policy that will certainly pay for property damages up to $50,000 will certainly have a higher costs than one that only pays for repair work up to $25,000. Typical Car Insurance Policy Rates by Age Your vehicle insurance policy rates will also differ based upon your age team. affordable. car insurance firms frequently take into consideration young motorists, like teens, to be more of a danger behind the wheel.

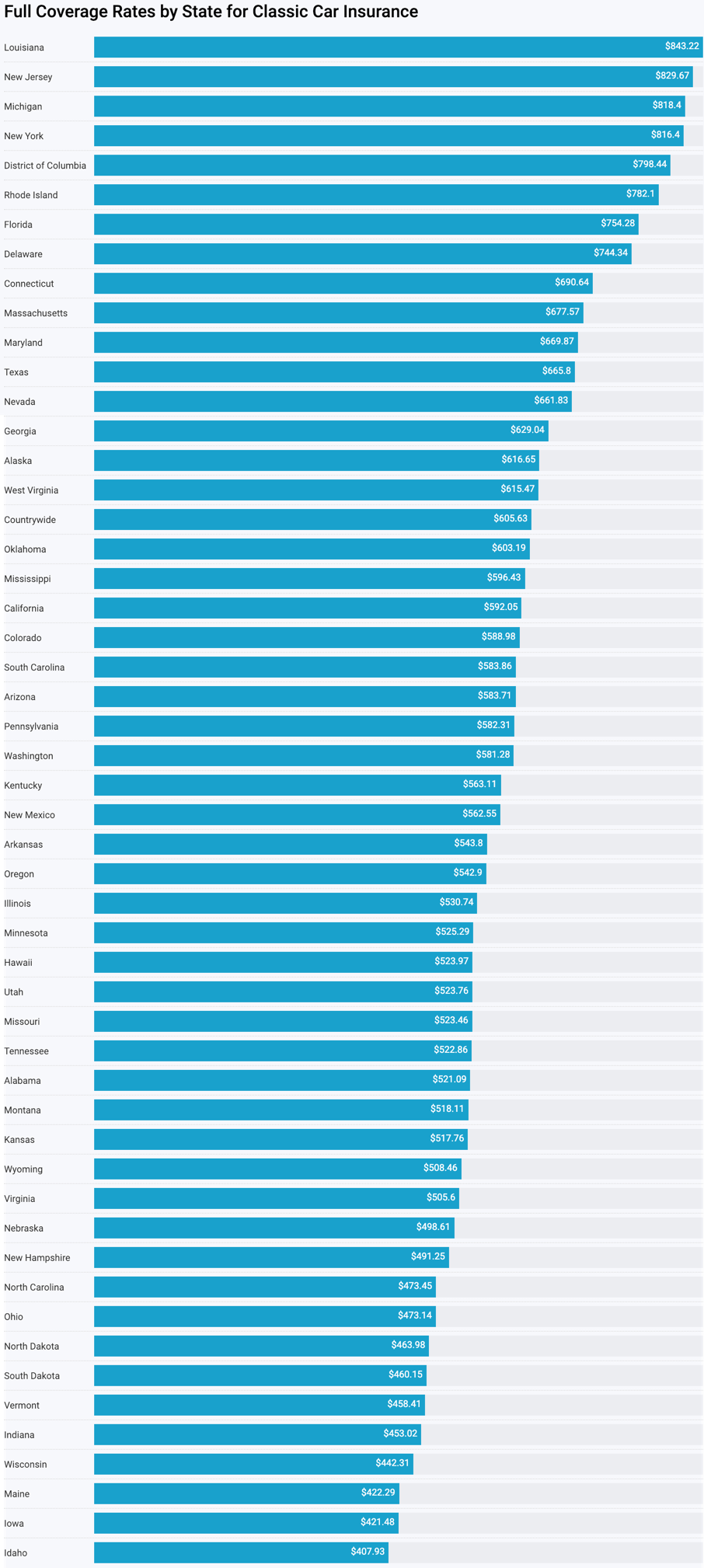

On top of this, vehicle insurance policy is commonly much more expensive for men than females. liability. 3 The longer you've been driving and also the older you get, the less costly vehicle insurance policy rates have a tendency to be. Ordinary Auto Insurance Coverage Prices by State The typical automobile insurance coverage rate by state varies. According to the Insurance Coverage Info Institute (III), Iowa has a few of the cheapest car insurance coverage in the nation at $674, while Louisiana had some of the most pricey at $1,443.

Not known Details About Average Car Insurance Costs In 2022 - Nerdwallet

At What Age Is Automobile Insurance Policy Cheapest? 5 That indicates as a driver gets older as well as acquires even more experience on the roadway, their rates will likely lower.

Which Age Team Pays the Many for Vehicle Insurance? Insurance policy business commonly bill a lot more for drivers that are under the age of 25. Given that 1984, The Hartford has aided virtually 40 million AARP members obtain the vehicle protection they need through special advantages and discount rates What State Has the Cheapest typical auto insurance policy rates?

They'll aid you obtain the automobile plans you require, whether it's to assist spend for problems after a mishap or to protect you from crashes with without insurance drivers - car insurance.

Despite the appeal of the term, there is actually no policy called "full insurance coverage vehicle insurance." To put it simply, insurance carriers do not use a vehicle insurance plan that covers whatever. Nonetheless, what is considered complete coverage auto insurance by some is the combination of thorough insurance, accident insurance policy and also obligation insurance policy.

More About Business Digest - Volume 5 - Page 67 - Google Books Result

However, there are still lots of variables that impact your insurance policy prices, including: Your age Your area Your driving record The kind of cars and truck you drive The plan kind(s) you choose Your insurance deductible Your policy restriction(s) So, just how much does full insurance coverage automobile insurance cost? The response depends partially on you and also your history, in addition to the type and amount of insurance coverage you pick.

55 in 2018 (one of the most current year covered in the record). Your own costs may vary. The quickest method to figure out how much a cars and truck insurance policy would cost you is to make use of a quote calculator tool. Enter your postal code listed below to receive totally free, instantaneous insurance quotes from a few of the ideal car insurance coverage business in your area.

Various states likewise have different driving problems, which can influence the expense of cars and truck insurance. To offer you some suggestion of what chauffeurs in each state spend each year on car insurance coverage, the table listed below shows the average expense of automobile insurance policy by state, according to the 2021 NAIC Auto Insurance Data Source Report.

Bundling: Bundling your house and also car insurance policies generally results in premium price cuts. perks. If you are able to pay your entire costs at as soon as, it's frequently a much more affordable choice.

The Ultimate Guide To How Much Is Car Insurance? - The Balance

Our methodology Since customers depend on us to supply objective and also exact information, we developed an extensive score system to formulate our positions of the very best cars and truck insurance coverage companies (low-cost auto insurance). We gathered data on lots of auto insurance suppliers to grade the business on a wide variety of ranking factors. The end outcome was a total rating for each service provider, with the insurance firms that racked up one of the most points covering the checklist.

Availability: Auto insurance coverage companies with better state availability and also couple of eligibility needs racked up highest in this classification - trucks. Protection: Companies that use a variety of selections for insurance policy coverage are much more likely to fulfill consumer requirements.