It can be a bargain for motorists who agree to pay a little added for peace of mind. Not everyone is qualified for mishap forgiveness it's typically only offered to motorists that currently have a spick-and-span driving history. That suggests, paradoxically, that the chauffeurs who would most need mishap forgiveness may not qualify.

risks insurance company liability low cost

risks insurance company liability low cost

The cost of the insurance claim - Not all insurance claims are weighed the exact same; a minor fender bender might not boost your costs yet a major accident where a lorry is totaled more than likely will, Your driving background - If you have actually gone several years with no accidents or infractions, your insurance firm might not raise your rates for a minor crash.

vehicle affordable car insurance car insured insurance

vehicle affordable car insurance car insured insurance

cheap car auto insurers vehicle insurance

cheap car auto insurers vehicle insurance

Your insurance provider may be most likely to increase your rates if you were the at-fault chauffeur Will my rates increase after a no-fault crash? Your cars and truck insurance can also step in in cases where you're not to blame. car. If you're in an accident created by an additional vehicle driver, or your parked cars and truck is struck, you may still need to submit an insurance claim with your insurer, which might deal with the at-fault motorist's insurance to cover your losses (automobile).

Store around for brand-new insurance coverage, Shopping around for new car insurance protection is one of the most reputable methods to conserve cash on insurance policy prices (vehicle insurance). If your existing insurance company informs you that your rates are rising, it may be worth getting some quotes from other insurance providers to see if you might be getting the very same insurance coverage for much less. cheaper cars.

3. insurance. Wait it out, As we stated above, accidents do not remain on your document for life. If you've just sued for an at-fault mishap, your rates might increase, once a couple of years pass that accident will no longer influence your prices. Make certain to do whatever you can to maintain a clean driving document going forward so you will not need to file anymore at-fault claims or have insurance claims filed against you.

What Does Auto Insurance Rates Are Rising Sharply In Illinois, As Drivers Hit ... Mean?

Discover exactly how much insurance boosts after an accident for various sorts of motorists in 2022. insured car., Auto Insurance Writer, Jan 20, 2022 (dui).

Right here are a couple of aspects that can affect your prices after a mishap: Your business's internal processes The number of crash cases you've filed in the previous 5 years The severity of the offenses on your document in the past 5 years The overall expense of claims versus you How Lengthy Will My Insurance Coverage Fees Remain Up After a Crash? Cars and truck insurance coverage rates https://autoinsuranceloop.z9.web.core.windows.net can stay elevated after a crash for three to 5 years. laws.

How to Conserve on Vehicle Insurance Policy At American Family Insurance Coverage, you've got options to assist decrease the cost of your costs. Take an appearance at some of our fantastic offerings and discounts: Utilize accident mercy with a great driving record We offer crash mercy as a means to reward good drivers (auto insurance).

At the time of your mishap you will be 100% "forgiven" for one accident per plan and also there will be no impact to your premium. The terrific part regarding mishap mercy is that you're additionally able to buy this protection too (insurance). That can assist to keep your rates down, if your current driving record is less than best.

Claim Filing FAQs After having a mishap, you've most likely got a whole lot on your mind. And you might have a few questions regarding what that mishap is going to do to the cost of your automobile insurance policy. We have actually got some solutions for you:.

The Only Guide to 7 Factors That Affect Car Insurance Rates - Farm Bureau ...

Why did my insurance policy go up? If you relocate to a location where just a few people obtain into crashes and not lots of automobiles are taken, there's a great opportunity your auto insurance policy price will go down (presuming whatever else in your life remains the exact same) (trucks).

If you move to a different state, that's harder to predict. Each state regulates insurance policy in different ways, and the distinction in expense can vary widely.

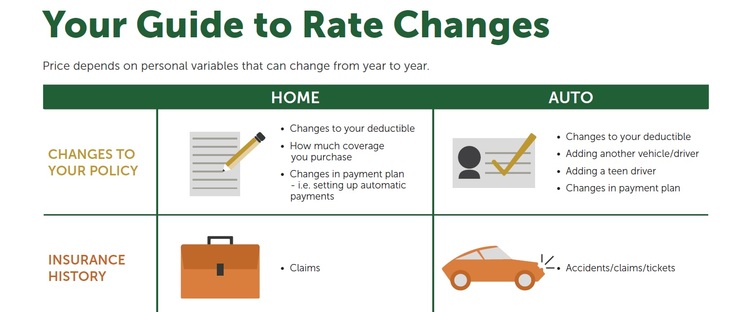

When you alter the automobile lineup on your plan, the rate of your insurance policy will nearly certainly be affected. It's crucial to keep in mind that the other individuals on your plan can affect your price in other means, as well.

Your car insurance coverage price vs. the world, When the world around us modifications, those changes can have a significant effect on automobile insurance rates. Even if you're the most effective driver on the planet, a person can collapse right into you - trucks. Also if you're very mindful, somebody might steal your automobile (insurance). If the rates for accidents and also burglary rise or down in your location, your insurance policy prices will certainly follow.